© 2025 Bemobi. All rights reserved.

Why are digital plans key to the future of Telecom?

It is inevitable to think that the pandemic changed the world, and as a consequence, it changed us. In 2020, companies and users woke up to the power of digital service models which continued to gain ground in 2021 as the economy began to recover.

As a result of this highly technologized context, mobile operators accelerated their evolution towards a commercial structure of bundled digital services with fixed features and prices, facilitating access and user experience in service consumption. However, this process of digital transformation is not progressing at the same pace as payment processes.

While the industry has begun to offer digital payment services, they are still lagging behind compared to other options available in the market:

1) The lack of a consolidated and unified payment ecosystem hinders the widespread adoption of the service by users. Additionally, operational experience and transaction security are also critical factors that require significant improvements.

2) There is limited collaboration and partnership with other actors in the financial transaction environment, such as banks and payment service providers, which limits interoperability and the ability to offer a more digitized user experience.

3) Processes that still operate under the traditional model, such as activation and subscription, continue to require user presence. The same applies to the delivery of tax and billing documents to workplace or home locations, as the appropriate digital channel is not enabled. Both situations create friction in the customer journey and affect their need for a 100% digital experience.

According to a 2023 report by Statista, nearly 60% of users in Brazil consider the possibility of conducting financial transactions through mobile devices in the future, making it a key market for digital payments. The wide variety of tools available in Brazil, such as Pix, PicPay, PayPal, Google Pay, Apple Pay, and Masterpass, has enabled 10% of mobile payment users to be 60 years or older, expanding usage beyond younger generations.

According to a 2023 report by Statista, nearly 60% of users in Brazil consider the possibility of conducting financial transactions through mobile devices in the future, making it a key market for digital payments. The wide variety of tools available in Brazil, such as Pix, PicPay, PayPal, Google Pay, Apple Pay, and Masterpass, has enabled 10% of mobile payment users to be 60 years or older, expanding usage beyond younger generations.This is where mobile operators need to make a significant difference to bridge the gap between this mobile service offering and outdated payment models. The solution? A model that understands the current behavior of hyperconnected users, who are not interested in a complex journey experience involving document reviews, but rather require a flexible service with self-management and online activation, as well as multiple online billing alternatives such as credit cards and/or digital wallets.

Bemobi Approach

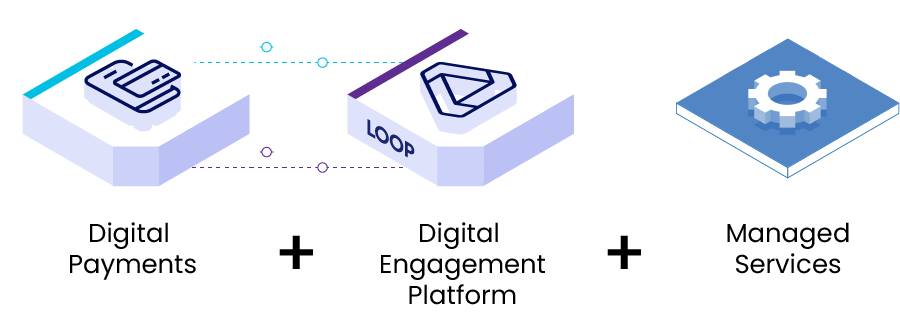

Understanding the contexts and needs of users, our solutions act as a bridge that ensures a seamless payment experience with multiple alternatives, aiming to achieve a fully digital performance.

We combine a recurring billing engine that manages various payment alternatives, plus the management of our omnichannel Loop solution, to orchestrate presence in all digital customer interactions, thus improving their experience and subsequent conversion.

We made a white label solution to face the challenge of digitizing mobile operators, with the necessary service management intelligence to make it more efficient and scalable. That is where its true value lies.

RECURRING PAYMENT + 100% DIGITIZED SERVICE= UX INCREASE

Our digital model: Simplify and Add Value

Upon detecting this significant inclination towards paying bills with credit cards, we have developed a Managed Services model that features an intelligent recurrence engine for the subscription and purchasing process. This allows us to obtain a comprehensive commercial payment and credit history of the user, accurately understand their context, preferences, and performance, with the aim of offering them the best possible digital journey.

A fully digital experience

Our solution reflects Bemobi's extensive experience in developing subscription platforms with an innovative focus on a fully digital channel. This translates into a better user experience, more effective time to market, increased revenue, and lower operating costs. As a result, customer loyalty and Lifetime Value (LTV) are enhanced.

This platform considers four features:

1. Native Offer Catalog

This intelligent portfolio maps the user's journey, providing the operator with the ability to generate completely innovative and personalized plans according to the customers' needs, with eligibility rules, offer hierarchy, pricing, and validity, without depending on the supporting legacy infrastructure:

- "Lego" type offers. While the traditional model remains rigid, Bemobi combines and reuses packages to accelerate time-to-market.

- Flexibility to create segmented, geolocated, and special date offers and campaigns without relying on operator development.

- The user can choose between a standard plan or customize their own package.

- Administrator access, providing autonomy and independence from support teams.

2. Simplified Subscription

By simplifying the subscription and activation steps, a smoother user experience is ensured at all stages of the onboarding process.

- Both new and existing customers can activate and pay through their mobile application, obtaining a 100% digital self-service experience.

- In the case of eSIM, users can activate them while configuring their digital plan account.

- Simplified mobile number portability process available to users throughout the activation journey.

3. Self-Service and Usability

This aspect focuses on the user's self-service capability and having user-friendly and intuitive platforms that allow them to manage their contracting and support process entirely digitally.

- One channel, multiple functions: tasks such as mobile data usage, balance verification, top-ups, payment history, plan changes, and available offers in an easy-to-use interface.

- Customers can seek assistance in the application through chatbots, reducing costs associated with a call center.

- If human contact is required, Bemobi has a web-based tool with information and functions available for different user profiles.

4. Digital Billing and Collection

All the benefits of Bemobi's Recurrence Platform in one place, providing the best conversion rates while making the billing and collection process more efficient.

- Intelligent and digital charging system that increases payment conversion and retries, avoiding penalties and additional charges.

- Multiple payment backup options (Pix, top-ups, debit) with integrated communication in the application interface, push notifications, WhatsApp, and email.

- Option to offer backup offers: "Small data packages" to increase conversion.

How does the Bemobi model benefit our costumers?

Reduces bad debt and increases conversion rates

Thanks to the automation of our recurrence engines, we simplify the billing process and detect overdue payment histories and outstanding balances. Additionally, through advanced credit and risk analysis, we provide key information for evaluating customer spending patterns prior to the subscription stage, ensuring good portfolios.

Furthermore, by offering flexible payment options, we increase the conversion of potential customers into active subscribers, thereby improving retention.

Greater upsell opportunities

Our ability to interpret alternative mobile data allows us to gather valuable insights based on user purchasing habits and preferences, enabling us to personalize offers and additional services. In this way, companies increase the effectiveness and scalability of their upselling processes by having all the necessary customer context information.

Bemobi's experience in Brazil, where we have 77% penetration in credit card billing, has been key to building a digital relationship with users, with new and better offers and more efficient orchestration of payments.

Bemobi's experience in Brazil, where we have 77% penetration in credit card billing, has been key to building a digital relationship with users, with new and better offers and more efficient orchestration of payments.Bemobi is currently a leader in providing multiple payment gateways and recurrence models to enable and bill mobile plans.

Why are digital plans key to the future of Telecom?

➔ Mobile services offered by operators have evolved along with the needs of their users, however, the form and payment channels have not done so in the same way.

➔ The payment experience for subscription services has increased dramatically in recent years, and therefore mobile operators must look to the future in this same direction.

➔ At Bemobi we have created a solution adapted to the needs and behaviors of this new digital era, which solves real problems in the billing, payment and acquisition processes of mobile telephony.

➔ Along with the digitization of services, it is necessary to evolve the end-customer experience with simple, end-to-end self-managed, 100% digital payment and subscription platforms.

➔ Our model aims to enhance the experience of end-users while streamlining the internal processes that are typical of mobile operators, such as rating, credit scoring, monthly billing, and LTV calculation. By leveraging more accurate data history compared to traditional systems, we can simplify these processes and make them more efficient.