© 2025 Bemobi. All rights reserved.

The way we make digital payments is constantly evolving. One of the most recent innovations in this field is Click to Pay, a technology that promises to simplify and secure online transactions for both consumers and merchants.

But what exactly is Click to Pay and how does it work?

Click to Pay is an initiative created by major payment networks such as Mastercard, Visa, American Express, and Discover. Its goal is to provide a standardized, secure, and frictionless online payment experience, eliminating the need to manually enter card details for each purchase.

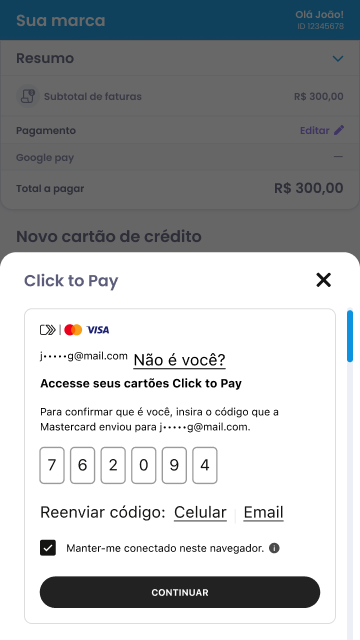

When a consumer chooses to use this method on a compatible website, they simply click on the Click to Pay icon on the checkout page. They are then prompted to select the card they want to use from the options they have saved, and if necessary, complete the user validation process (e.g., entering a code sent to their phone).

The transaction is completed without the consumer having to enter their card details each time, saving time and reducing the risk of errors.

Click to Pay uses tokenization and other advanced security technologies to protect user data, significantly reducing the risk of fraud.

By eliminating the need to manually enter card information for each purchase, Click to Pay makes online transactions faster and more convenient.

Backed by the major payment networks, Click to Pay is available at a large number of merchants worldwide.

According to a Mastercard study, shopping cart abandonment is one of the biggest challenges in e-commerce, with abandonment rates reaching up to 70% in some industries. Click to Pay helps reduce these figures by simplifying the checkout process, making it less likely for consumers to abandon their carts.

Click to Pay represents a step forward in the evolution of digital payments. By combining security, simplicity, and an optimized user experience, it has the potential to become the preferred option for online payments worldwide.

For merchants, integrating Click to Pay can lead to improved conversion rates and increased customer satisfaction.

If you need information on any of our payment solutions for Telecommunications, Utility companies, Education, Internet Providers, Healthcare or Finance, we invite you to complete the following form and we will contact you shortly.