© 2025 Bemobi. All rights reserved.

Authorize

Payment Orchestration

Companies that trust us

Intelligence to increase your revenue

Increase conversion

Reduce operational costs

Minimize delinquency

Smart Routing & Resilient Transactions

Optimized, Resilient, Seamless

Optimizing Payment Costs

Dynamic Business Rules

Resilient Processing

Dynamic Payment Gateway

Technology to enhance your transactions

Access to multiple acquirers

Own sub-acquirer

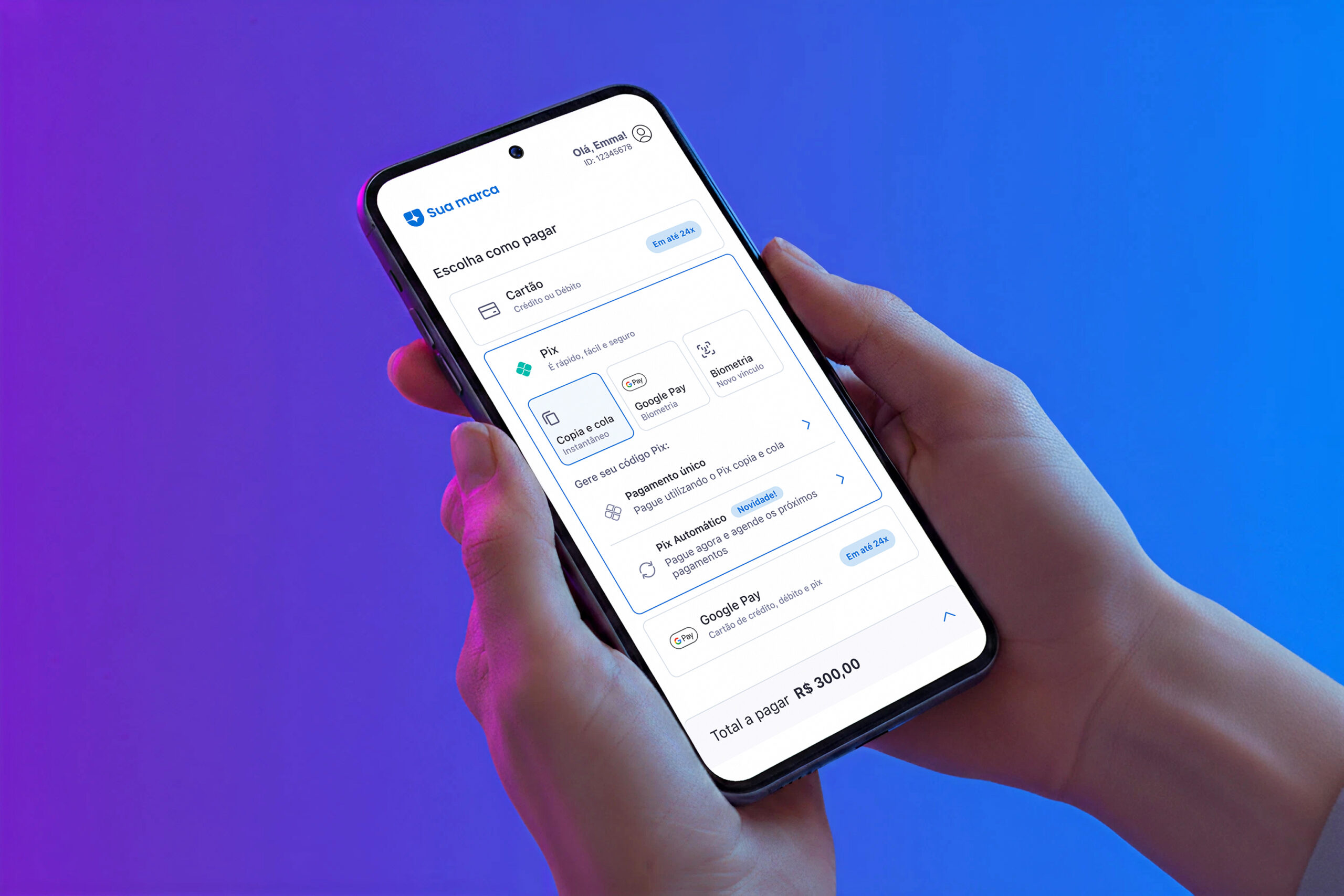

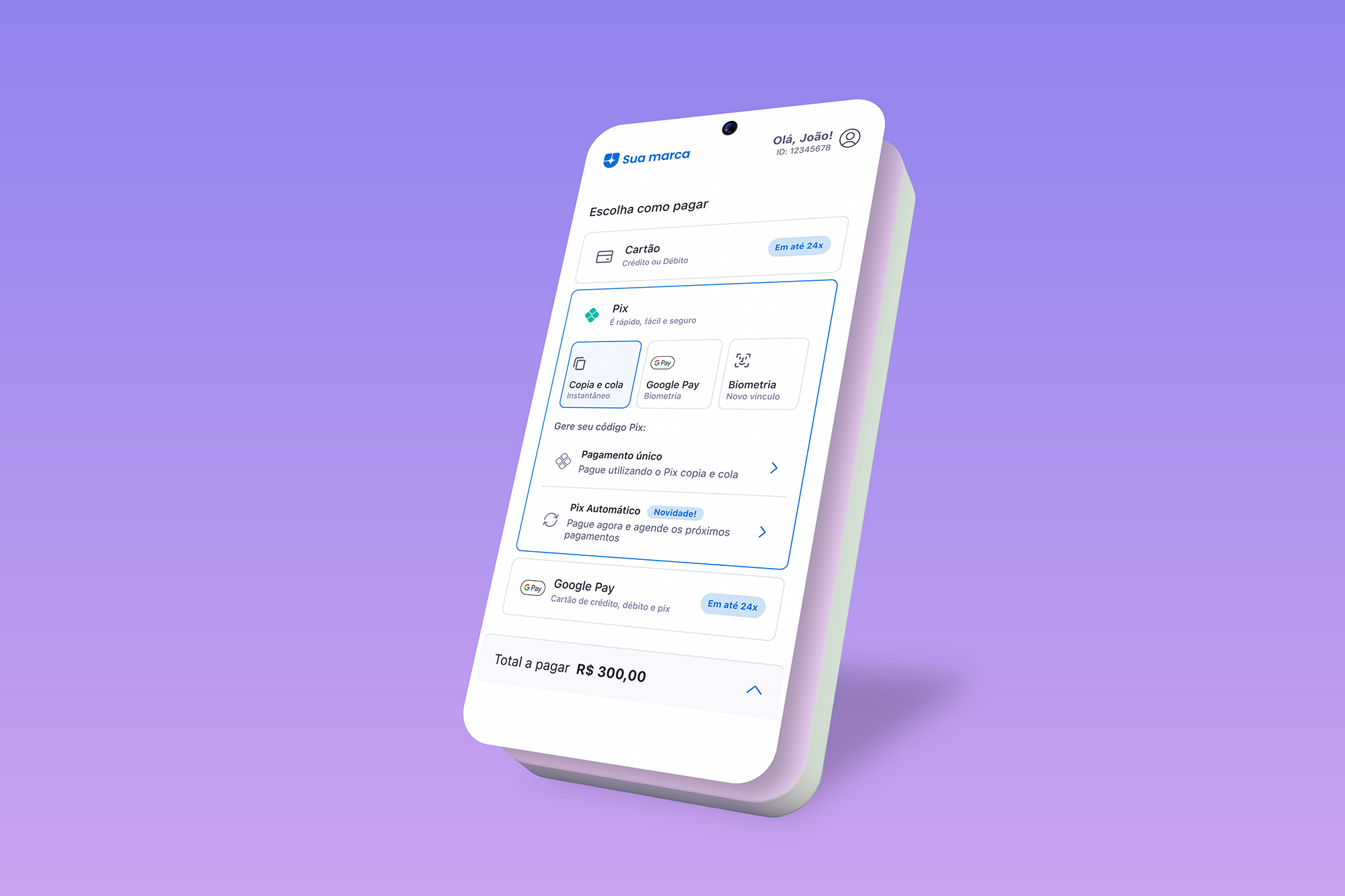

End-to-End Pix

Smart Retries and Recurrence Engine

Reduce failures and increase approvals

Adaptable Opt-in Journeys

Guaranteed payment

Stored data usage

Pix with biometrics

Failure-Based

Time-Based

BIN-Based Routing

Automatic fallback

Incentivized fallback

20%

of incremental

conversion

with Tokenization, Smart Retries and Multi Rail cascading

Installments - SNPL (Settle Now Pay Later)

Flexible installment options for your customers

Receive the full amount

Service fee for users

Secure and Prevention: Protect your revenue and ensure every transaction

3DS (Three-Domain Secure)

Fraud prevention integration

Reduction of false positives

Ready for the Next Step?

Online Payment

In-Person Payment

Simplify Payment Management

Related Content

AuthorizeBemobi PayDigital PaymentsFeaturesPix

Bemobi Launches Pix Orchestrator and Introduces in a New Era for Recurring Service Payments

2025AuthorizeBemobi PayDigital PaymentsFeaturesPix