© 2025 Bemobi. All rights reserved.

In the competitive world of recurring services, efficient payment and debt management is crucial to ensure customer satisfaction and financial stability for businesses. Bemobi has developed an innovative debt management portal designed to benefit both service providers and end consumers.

Bemobi’s deep understanding of user payment experiences has enabled the development of features that simplify this process. For Internet Service Providers (ISPs), where revenue streams are highly dispersed, efficient collection management is vital.

For end customers, it is essential to provide every possible convenience for making payments. This approach reduces the risk of delinquency and ensures a constant revenue flow for providers.

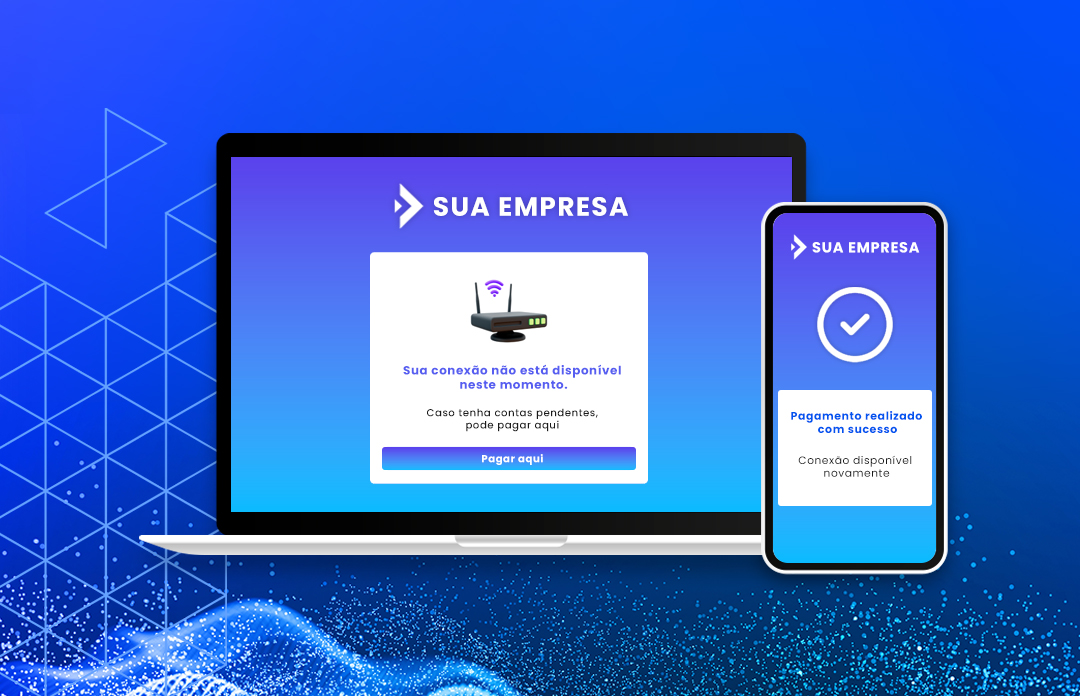

One of Bemobi’s most innovative solutions is its debt management portal for ISPs, which redirects users with outstanding debts to a specific page when they attempt to browse the Internet. This page informs them of their account status and offers immediate options to settle the payment. It works similarly to the authentication process in public Wi-Fi networks, where users are redirected to a registration page.

This portal significantly reduces friction for users with debts, allowing them to settle payments instantly through agile payment methods such as PIX or credit card and resume their internet connection immediately. It also avoids tedious and frustrating processes to resolve service blocks, providing a smoother and more satisfying experience.

A user who can quickly and easily resolve payment issues is more likely to have a positive perception of the service provider, leading to greater loyalty and long-term retention.

If you would like more information about our payment solutions for Internet Service Providers, please complete the following form and we will contact you shortly.