© 2025 Bemobi. All rights reserved.

Conversational platforms like WhatsApp are emerging as one of the preferred channels for making payments, due to their simplicity and massive reach. In Brazil, where 99% of mobile devices have this app installed and 95% of businesses use it, the next step is inevitable.

In a context where instant messaging is becoming one of users’ preferred channels to interact with brands and services, WhatsApp is evolving beyond its original function. The increasing integration of business features into these apps responds to a demand for smoother, faster, and more personalized experiences.

We’ll increasingly see features currently found in apps migrate to WhatsApp chats. In some cases, entire apps will make this transition.

Guilherme Horn, Head of Strategic Markets at WhatsApp (Brazil, India and Indonesia)

During the Abramulti 2025 event, Regis Camargo, Bemobi's Director for Health and ISPs, participated in a podcast hosted by Portal Canal ISP, where he discussed the topic: “A new era of recurring and conversational payments.”

In the interview, Regis addressed how Artificial Intelligence and WhatsApp are redefining the relationship between companies and people, combining automation, accessibility, and closeness to the user.

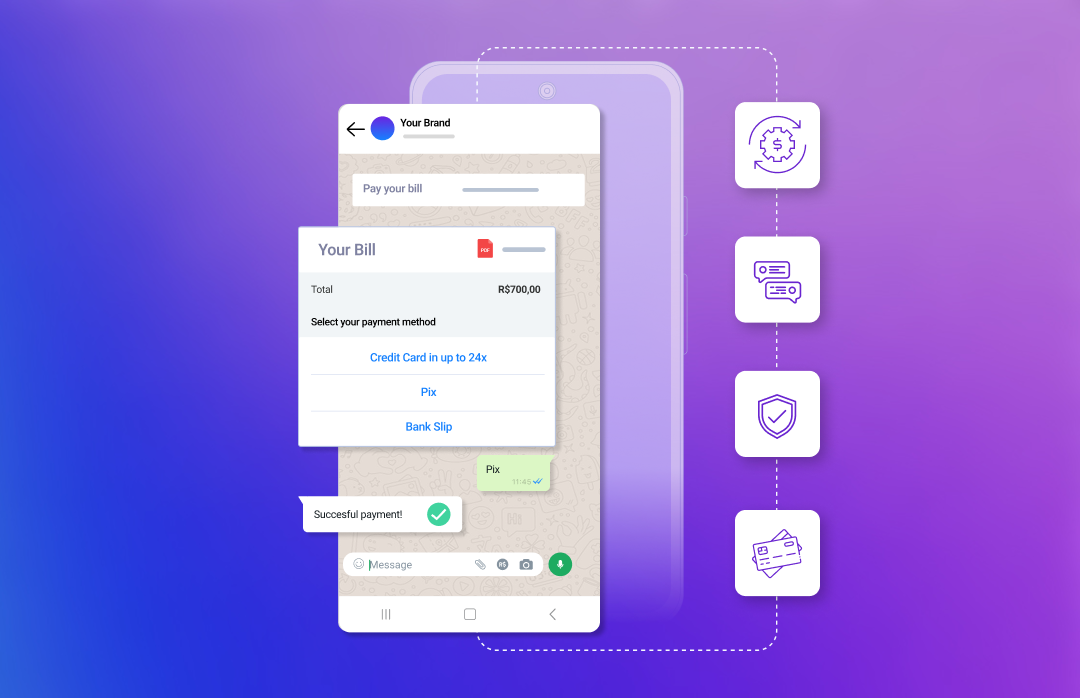

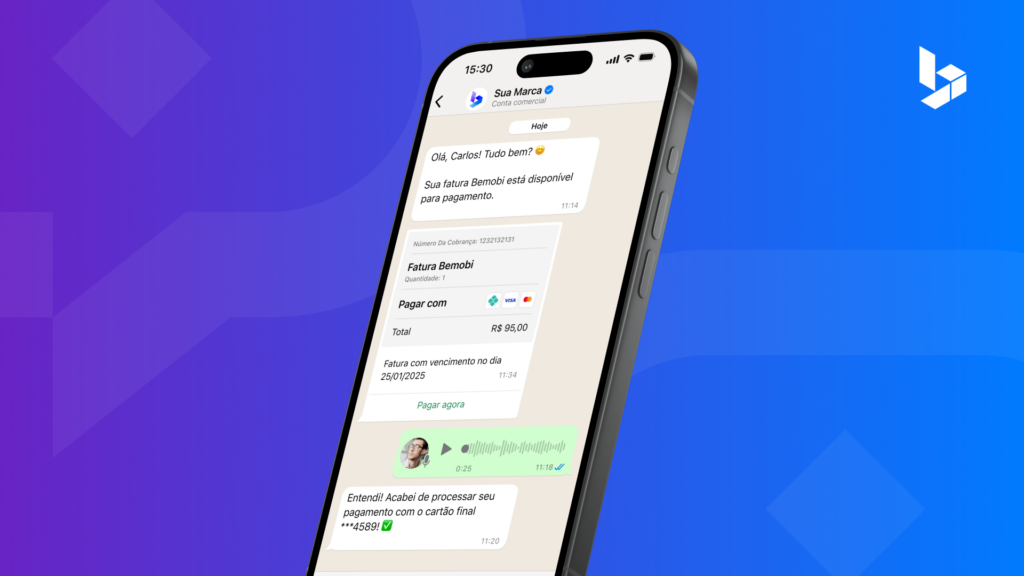

Our idea is for customers to resolve everything via chat: check, negotiate, and pay bills using credit cards, Pix, or digital wallets like Google Pay, making payments fast and easy through WhatsApp.

Regis Camargo, Director of Bemobi for Health and ISPs

It’s worth noting that with Bemobi Pay, businesses can integrate communication channels and multiple payment methods—such as cards, recurring Pix, and digital wallets—into a single platform. It’s a plug-and-play solution, eliminating the need for multiple providers, designed to reduce delinquency and increase conversion.

Bemobi’s smart bots are designed to operate 24/7, Regis explains, responding, negotiating, and processing payments within the same chat.

We offer smart bots that manage collections, negotiations, and payments via Pix, providing a fast, automated, and more human experience.

Regis Camargo, Director of Bemobi for Health and ISPs

The recurring payment model removes friction: users don’t have to remember to make a payment each month. The upcoming launch of Automatic Pix, scheduled for June this year by the Central Bank, will be a turning point.

We believe the future of payment is precisely not having to make it actively every month.

Regis Camargo, Director of Bemobi for Health and ISPs

You may also be interested in reading the following article: What is automatic Pix and how does it work?

For Internet Service Providers and healthcare companies, this translates into higher retention, less churn, and more satisfied customers.

Bemobi Pay is not just a payment gateway—it’s a digital engagement tool that adapts to current user behavior. It automates, humanizes, and optimizes every interaction. From the first contact to the final click, Regis concludes, Bemobi ensures that the payment happens without the user even having to think about it.

If you need more information about Bemobi Pay and our payment platforms, please complete the following form and we’ll be happy to contact you as soon as possible.