© 2025 Bemobi. All rights reserved.

Solution allows large companies, such as utilities and telecommunications, to modernize their payment operations without the need for complex and time-consuming projects

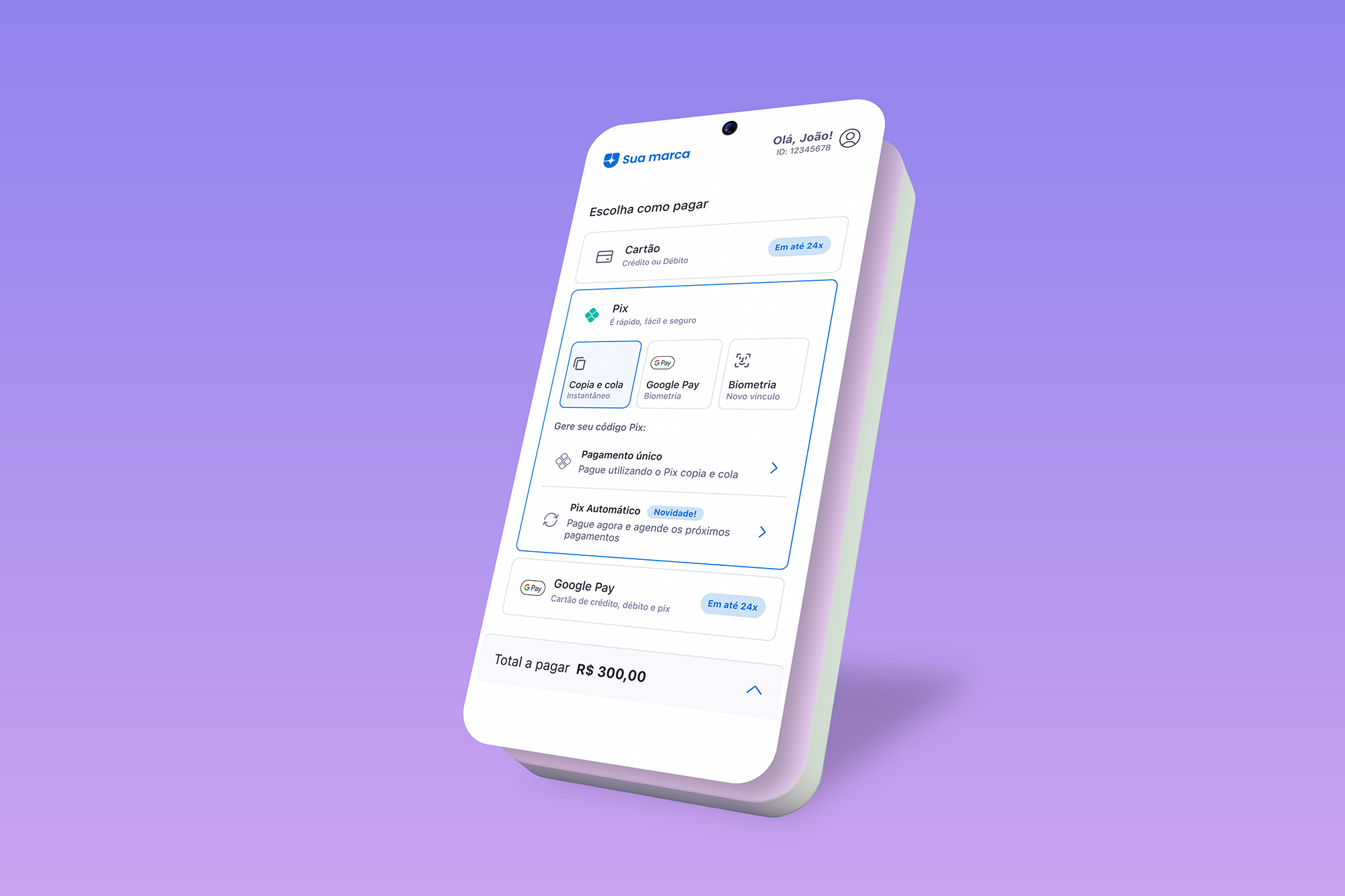

After more than a year of development, Bemobi (BMOB3), a leader in payment solutions for essential recurring services, announces the launch of the Pix Orchestrator. The new feature of the Bemobi Pay platform, which integrates and automates all Pix modalities, offers more resilience, efficiency, and control for recurring service companies such as utilities, telecommunications, internet providers, and educational institutions.

Since its launch in 2020, Pix has had a meteoric adoption and has consolidated itself as an essential payment method for companies and consumers. But, as new modalities emerged – such as Automatic Pix, Pix by biometrics, proximity payment, integration with digital wallets, and, soon, installment Pix – the operation became more sophisticated, yet also more complex.

Integration with multiple banks, checkouts, and legacy systems has made the payment environment harder to manage and less predictable. The Pix Orchestrator arises to solve this scenario, unifying flows and automating processes – without the need for long projects or complex integrations.

Pix has transformed the way people pay, but it still lacked transforming the way these payments are managed. The Orchestrator is born to simplify this process and ensure that Pix operates strategically, stably, and intelligently within companies,” says Pedro Ripper, CEO of Bemobi. “Many companies still operate in a fragmented ecosystem, depending on a single provider and unable to explore the system's full potential. The result is low adherence to more efficient modalities, such as Automatic Pix, and a lack of preparation to deal with instabilities, directly impacting revenue. For us, it’s not enough to offer payment via Pix; it’s necessary to orchestrate it, eliminating all these barriers.

Bemobi's new solution acts as an intelligent decision engine, capable of identifying the most efficient and secure route for each transaction, adapting to the context of each customer and channel (web, app, WhatsApp, POS). If an institution is offline, the system automatically redirects the payment to another partner bank, with no impact on the end consumer.

The Smart Retry feature automatically reprocesses failed payments and triggers alternative methods – such as credit card or payment link – guaranteeing revenue continuity and reducing losses. Furthermore, Bemobi Pay adopts the BYOP (“Bring Your Own Pix”) model, allowing each company to connect the Pix from its own banks within the platform, gaining autonomy and reducing dependence on a single provider.

To make the implementation of new Pix functionalities more agile and simple for end customers, Bemobi Pay abstracts a layer of complexity for companies. For example, for Automatic Pix, the platform was developed to operate in hybrid environments, connecting to modern systems via APIs and to legacy systems via CNAB files. This flexibility allows large companies in the recurring services sector to modernize their payment operations without the need for complex and time-consuming projects.

The true evolution of Pix for companies lies in the intelligence that surrounds it — the ability to guarantee revenue, anticipate failures, and quickly adapt to new modalities. In a short time, it will be unthinkable for a large corporation to operate without a Pix orchestration

concludes Ripper.

If you want to know more about Bemobi’s Smart Checkout and Payment Orchestrator, we invite you to fill out the form below. We will be happy to contact you as soon as possible.