© 2025 Bemobi. All rights reserved.

In a landscape where digital experiences define customer loyalty or abandonment, digital payments must be highly effective with UX playing a pivotal role at every stage of the process.

For sectors providing essential services like telecommunications, ISPs, education, finance, and healthcare, efficient and personalized billing is not optional, it's a critical need.

Payment habits in Latin America have evolved dramatically. Digital consumers now use Pix with one click, digital wallets with proximity technology, and expect seamless auto-renewals for subscriptions.

This evolution reveals a stark contrast between user expectations and what many large companies can deliver.

As consumers move toward a frictionless financial ecosystem, traditional businesses struggle to integrate diverse payment options into legacy systems. This disconnect creates a gap between the brand's digital promise and the crucial moment of payment.

A common example: a user navigates a sleek app but is redirected to a generic, unreliable payment page with manual processes. This break in experience has far-reaching implications.

The digital payment gap results in:

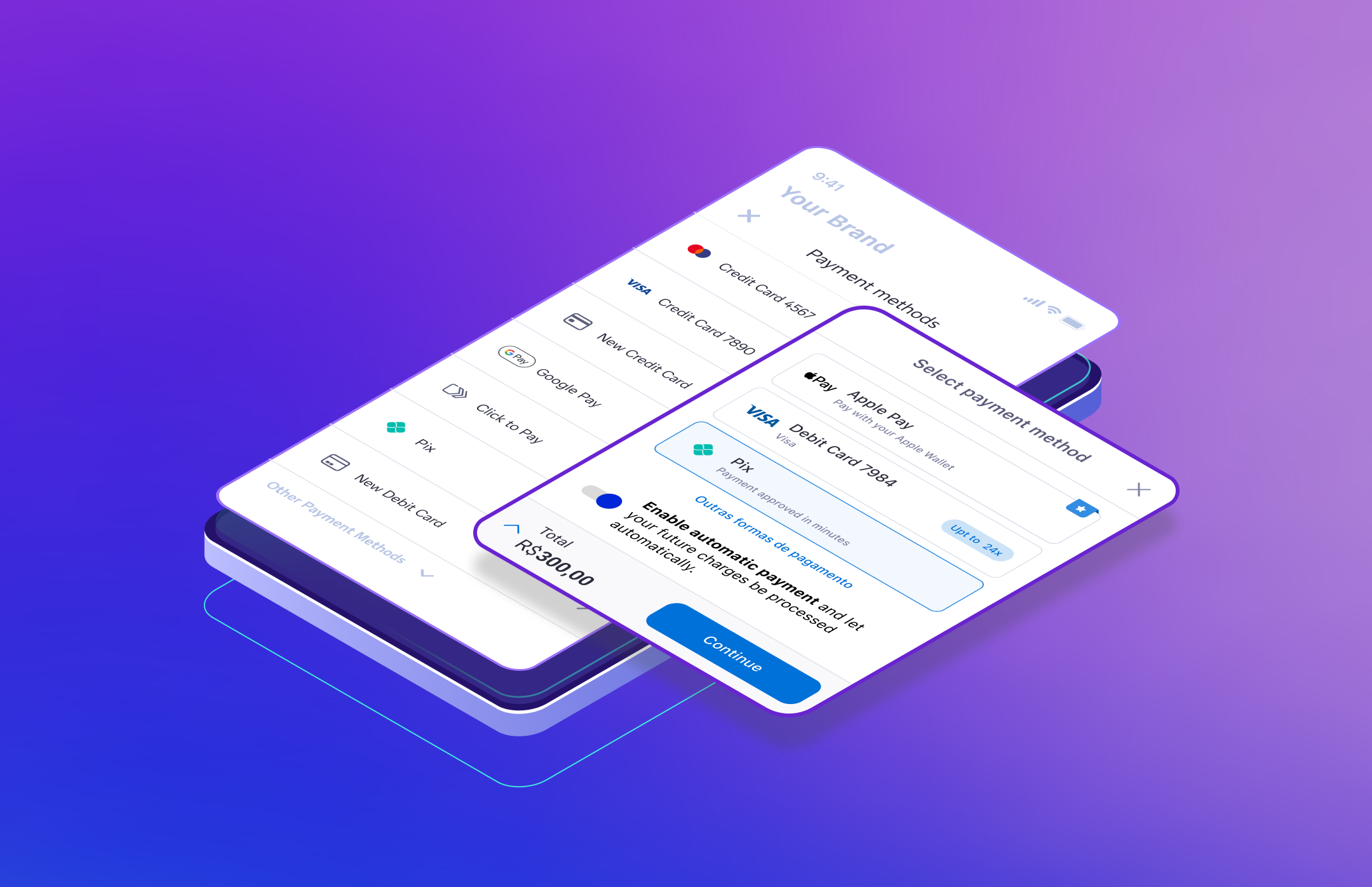

Instead of building complex systems from scratch, companies can opt for a more effective alternative: Bemobi Pay’s Smart Checkout. This white-label platform bridges modern consumer expectations with enterprise capabilities.

Its robust, flexible design enables a secure, seamless payment experience across all digital channels without overburdening technical teams. It’s an efficient, user-centered transformation aligned with today’s market demands.

YDUQS, one of Brazil's largest educational groups, sought to modernize its payment ecosystem for over 1.3 million students. The goal: improve experience, reduce delinquency, and optimize collection.

With Bemobi Pay, YDUQS implemented an omnichannel, intelligent system starting with its billing portal, then expanding to its app and student web portal. Smart Checkout introduced:

This partnership not only reduced delinquency but also strengthened student trust through flexible, accessible recurring payment experiences positioning YDUQS as a leader in education digitalization.

For more details, see the official press release: YDUQS announces partnership with Bemobi to digitalize payments

Adopting a Smart Checkout solution like Bemobi’s isn’t just a tech upgrade, it’s a strategic move for business sustainability and competitiveness. In a customer-experience-driven world, the benefits are tangible and measurable:

Payment transformation is no longer optional, it’s an urgent reality. The key question now is: “How fast can we make the shift?”

In this fast-paced environment, Bemobi’s offering stands out as an end-to-end strategy combining technology, agility, and business intelligence with the ultimate goal of maximizing revenue while delivering seamless, trustworthy digital payment experiences.

Interested in how Bemobi Pay’s Smart Checkout can enhance your recurring payment model? Complete the form for more information, and we’ll contact you shortly.